US stock indices fell hard at the open last night on further signs of slowing in the recovery they've had since the depths of the GFC. The indices recovered from the open but still closed well down. Although rates are going to stay low for a long period, fiscal stimulus programs are tapering off now and I find it hard to see further upside in the medium term as momentum in the US stock markets fades. Here's a monthly chart for the S&P 500. It's been a strong rally but probably a retracement rally and it might be difficult for it to test the swing low at 1200, the break of which triggered the big acceleration down in the middle of 2008.

On a daily and weekly basis the trend is intact with higher highs and lows but a look at some of the other major markets shows that divergence is developing. For example, the FTSE and the Hang Seng are following the S&P 500 but the DAX, the CAC, the Kospi and the Nikkei have all broken their uptrends, like the Xjo, even if they haven't all developed downtrends.

Just over an hour into the trading day and we've fallen in line with US markets continuing that recent theme of underperformance given that we seemed to be expecting this weakness for the last few days. We're down 1.3% which is only just above the day's lows. My positions are slightly outperforming with the exception of Aoe, which disappointed expectations by failing to announce anything to excite the market. It has dropped 9 to 413. I sold a few at 415 (v 396) and retain just under half of my position. Bsl has gone through my stop level but has found support so I'm hanging in temporarily to see if I can exit at a better level.

Aristocrat is the one that got away - I was tempted to short it yesterday afternoon but decided to wait for a retracement to get in at better levels. It's the biggest loser in my watch list down 5.5% at 431.

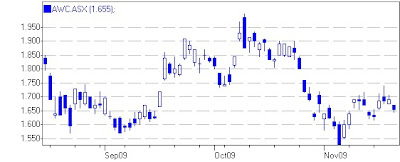

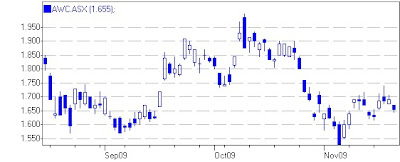

11.36 I've put on a partial short in Awc at 165.5 as it looks very much like All. The index is still trying to rally so I'll wait before completing the selling. The Awc chart shows a lower low compared to September and (if it's complete) the bare minimum that you might expect from a retracement rally.

Ipl is an odd chart and I've decided to sell out my balance on a trailing stop as I'm not quite sure what to make of the daily while the 60 minute shows a 5 wave pattern potentially completed. Out at 284 (v 262 plus a divident of 2.3 c).

Also out of Bsl at 283 (v 290.5), so slightly better than the stop level of 280.

12.40 Bsl is interesting actually, a fractional new low but generally holding support, it's now back to 285 so I could have been more patient. I'd actually been wondering whether this might happen and it could set up for another reversal trade on Monday.

On second thoughts, I'm probably too bullish. It did make a lower high in October and it's not surprising that there should be some support here.

On second thoughts, I'm probably too bullish. It did make a lower high in October and it's not surprising that there should be some support here.

In the meantime, I've completed selling Awc at 165 to average 165.25 and I've shorted Asciano at 161.5. Aio is more difficult but it looks like the retracement rally petered out rapidly after tracing out a choppy pattern. I think it's a reasonable reversal in what could be the early days of a downtrend with lower highs and lows forming.

2.06 The drop in Aoe gathered momentum so I sold the balance out at 404 (v 396). I'd normally like to give it the opportunity to rally after a pullback but the sell off has been pretty steep and there doesn't seem to be much support.

3.24 Interestingly Bsl is now up 2 on the day to be 288 so I could definitely have stopped out at better levels. I'm still in two minds about this one.

The market has held the line from this morning. I shorted All at 432 and bought it back at 425 as I tried to get something out of this missed opportunity.

4.10 Regional markets have strengthened during our afternoon session and we've lifted slightly. I'm now only long Csr and Qan and short Aio, Awc, Djs and Tse. It hasn't been a particularly good day but neither has there been any real harm done and the week has been solid. The increased possibility that we've made a high here suggests that there could be some nice trades on the short side in the weeks to come.

Overall, the Xjo closed down 63 points.

By the way, the weakness in Europe has accentuated the divergence compared with the DJIA and to a lesser extent the S&P500 and NASDAQ which haven't made new highs.

By the way, the weakness in Europe has accentuated the divergence compared with the DJIA and to a lesser extent the S&P500 and NASDAQ which haven't made new highs.

2.56 We're back around the lows now with the Xjo index down 16 points.

2.56 We're back around the lows now with the Xjo index down 16 points.

Still, none of the shorts are rallying so far.

Still, none of the shorts are rallying so far.

I haven't taken it yet because I feel like I've got this same trade on in various stocks. I think I'd prefer to take it tomorrow if there's some continuation and I haven't missed too much. Meanwhile, the market is on its highs for the day, up 33 points.

I haven't taken it yet because I feel like I've got this same trade on in various stocks. I think I'd prefer to take it tomorrow if there's some continuation and I haven't missed too much. Meanwhile, the market is on its highs for the day, up 33 points.

This would still be quite risky because there's key support at 293 but given the weekly charts for both steel stocks and recent reports of a Chinese steel glut, I'm tending to the bearish side.

This would still be quite risky because there's key support at 293 but given the weekly charts for both steel stocks and recent reports of a Chinese steel glut, I'm tending to the bearish side.

Telstra, above, is not the most exciting stock for my time frame but it's pulling away from the low in September and I've bought on the pivot created by Friday's pullback. The last two slow grinding upswings have created a base and the fact that the last swing didn't show any acceleration implies that it could be a larger pattern with a 3rd wave move to come. My main concern here is that the last swing had a deeper pullback and I don't want a repeat of that. Long at 333. Looking at the macro picture, if the market top is in place then this quintessential defensive stock could certainly go for a run.

Telstra, above, is not the most exciting stock for my time frame but it's pulling away from the low in September and I've bought on the pivot created by Friday's pullback. The last two slow grinding upswings have created a base and the fact that the last swing didn't show any acceleration implies that it could be a larger pattern with a 3rd wave move to come. My main concern here is that the last swing had a deeper pullback and I don't want a repeat of that. Long at 333. Looking at the macro picture, if the market top is in place then this quintessential defensive stock could certainly go for a run.

On a daily and weekly basis the trend is intact with higher highs and lows but a look at some of the other major markets shows that divergence is developing. For example, the FTSE and the Hang Seng are following the S&P 500 but the DAX, the CAC, the Kospi and the Nikkei have all broken their uptrends, like the Xjo, even if they haven't all developed downtrends.

On a daily and weekly basis the trend is intact with higher highs and lows but a look at some of the other major markets shows that divergence is developing. For example, the FTSE and the Hang Seng are following the S&P 500 but the DAX, the CAC, the Kospi and the Nikkei have all broken their uptrends, like the Xjo, even if they haven't all developed downtrends.

Also out of Bsl at 283 (v 290.5), so slightly better than the stop level of 280.

Also out of Bsl at 283 (v 290.5), so slightly better than the stop level of 280. On second thoughts, I'm probably too bullish. It did make a lower high in October and it's not surprising that there should be some support here.

On second thoughts, I'm probably too bullish. It did make a lower high in October and it's not surprising that there should be some support here. 2.06 The drop in Aoe gathered momentum so I sold the balance out at 404 (v 396). I'd normally like to give it the opportunity to rally after a pullback but the sell off has been pretty steep and there doesn't seem to be much support.

2.06 The drop in Aoe gathered momentum so I sold the balance out at 404 (v 396). I'd normally like to give it the opportunity to rally after a pullback but the sell off has been pretty steep and there doesn't seem to be much support. 3.24 Interestingly Bsl is now up 2 on the day to be 288 so I could definitely have stopped out at better levels. I'm still in two minds about this one.

3.24 Interestingly Bsl is now up 2 on the day to be 288 so I could definitely have stopped out at better levels. I'm still in two minds about this one.

The value of my approach to sell the first swing high after a pullback is highlighted here because I sold out two days back. I was wondering then if I should give it more room but with the benefit of a couple of days more action, it's interesting that with the lower low early this month, the stock has had a fairly standard retracement rally. I missed my chance on the close yesterday but it's a good lead indicator for a couple of my other stocks which are looking similar.

The value of my approach to sell the first swing high after a pullback is highlighted here because I sold out two days back. I was wondering then if I should give it more room but with the benefit of a couple of days more action, it's interesting that with the lower low early this month, the stock has had a fairly standard retracement rally. I missed my chance on the close yesterday but it's a good lead indicator for a couple of my other stocks which are looking similar.

The S&P 500 is broader and more indicative of the market than the DJIA so it's the best comparison to the XJO index below.

The S&P 500 is broader and more indicative of the market than the DJIA so it's the best comparison to the XJO index below. We're lagging by quite a distance and the market at 11 am has faded to be up only 20 points despite the strong lead being assisted by gold, oil and base metal price surges.

We're lagging by quite a distance and the market at 11 am has faded to be up only 20 points despite the strong lead being assisted by gold, oil and base metal price surges.  I bought a small amount of Asciano this morning as it pushed up through resistance. This is more of a 5th wave type trade and I'll probably just look for it to move to the top of the trend channel.

I bought a small amount of Asciano this morning as it pushed up through resistance. This is more of a 5th wave type trade and I'll probably just look for it to move to the top of the trend channel. Yesterday, Ost fell as low at 303 after I stopped out for 308 but then reversed to 314. It's up again to 317, has been as high as the breakout level (briefly) at 319 and I'm wondering whether to re-enter on the long side.

Yesterday, Ost fell as low at 303 after I stopped out for 308 but then reversed to 314. It's up again to 317, has been as high as the breakout level (briefly) at 319 and I'm wondering whether to re-enter on the long side. 11.32 Just gone long Qan at 278, looking for the next leg up.

11.32 Just gone long Qan at 278, looking for the next leg up. The market is only up 3 points now.

The market is only up 3 points now.