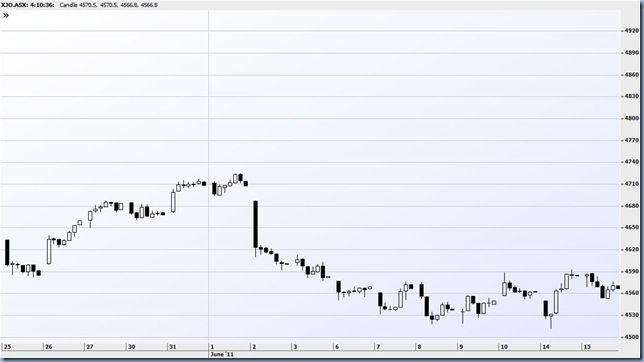

It's really not happening for this market. Another new low followed overnight weakness with the XJO index slipping below the 4512 low to hit 4507. It's been my fear, with this reversal trade, that the overseas downtrends would provide too much of a headwind and that's proving to be the case.

One bright spot is that the sell off has been perfunctory, even those who have been correctly bearish must be wary of putting on further short positions here and speculative longs bailing out are likely to be pretty limited.

I sold out of OSH on the open at 679, simply because the stock was going to open down by only a few cents and it had been stalling for 3 sessions. Instead, I punted a couple of other things on an intraday basis which I thought were overdone.

I sold out a third of my FMG last night at 630 so I'm using 615 as the stop for the rest. I should have hit the opening bid of 625 in hindsight because it's down to 619, but there was an announcement from foundation investor, Leucadia, that they had sold 82 million shares which is a large chunk of its holding. The stock is one of the most highly recommended in the market so I wanted to see if it would respond positively to the announcement.

12.27 The market is hovering around the 4510 area with Chinese and Korean markets fairly hard hit. I stopped out of FMG at 615, close to the intraday low, while OSH is actually up now! Story of this month.

1.20 I've just been reading Tim Price's "The Price of Everything" blog. As usual, he is making the case about the debasement of money but it's a case worth making and his big picture view has been spot on. This time, (referring to Chris Martenson's blog), he argues that despite the Fed's attempts to pump up the US economy, there is no way that credit growth will see anything like the exponential growth of the last 4 decades. My view is that the new austerity mirrors that of the post depression era and, allied with the improbability of reckless lending recurring in the next generation, the next bull market may be a very long term in coming.

I've started playing with a longer term book but I fear that I'm premature; the market needs to be super cheap and charting much more cleanly than it is now. I'm inclined to sell out my positions, which are only marginally against me, and look for another opportunity. Essentially, a buy write book is selling a put on the market and the downside risk is probably too large at the moment. Valuations are good but everyone fears that forward estimates must come down and until the downgrades are in, there's unlikely to be serious bargain hunting. The positions have broken support too, so having failed to write calls as I looked for more of a rally (no regrets about that, a strategy is a strategy), I can simply stop out.

1.40 The Australian market may well be due a rally but the weekly chart shows that the Asx 200 made a lower high in April and a break of the March low would confirm a trend change.

In the last year or so I've tended to do alright on the short side during sharp falls after good rallies (contrarian, reversals) but far less well in long slow downtrends. I need to get my head around the likelihood that we've seen the post GFC recovery. The big picture would imply a move below the 2009 low so I need to reverse my mindset to be patient with sell offs and impatient with rallies.

3.04 There has been another leg down in the market with the index closing in on the significant March low of 4477. Unless there's a strong rally in the last hour, the closing level will be the lowest since August last year.

I've been stopped out of all my positions. My longer term book has been postponed until I see a better base in the market but it hasn't been a disaster. I committed $300k into 5 stocks and it has cost me about 1.5%. If I had a 300 grand long across 5 of my more volatile trading stocks, the loss would have been more like 5%.

There's every chance I might be looking to trade reversal rallies in my trading watchlist over the next few days but I want to keep in mind the sense that markets are now structurally weak and longer term opportunities are going to be quite specific.

4.12 I was reading about confirmation bias in terms of the climate change debate earlier today and it was interesting reading the comments with people musing on the issue. It's not a fresh idea to traders, we deal with our own confirmation bias every day of the week and try to find ways around it. I've been well aware of being too bullish over the last 6 months but have really struggled to change my behaviour. In some ways, it comes down to the longer term road map I have of the market, and the index has come very close to confirming a major fork in the road with a close at 4479.2 which is less than 2 points above a weekly sell signal. If something like the FTSE is any indicator, the break is a foregone conclusion. This is one nasty looking chart.

Actually, that's not quite true...I've had a bearish long term view for a while but have still struggled to put on short positions. It's probably because our economy is reasonably healthy – despite the resources sector forcing up rates – and the difference is that the public has changed its behaviour. Plenty of companies are prospering but nobody wants to buy, it's hard to get my head around the change. One thing I've just done is to follow Tim Price's recommendation and sign up to Chris Martenson's blog. He seems to be an uber bear and the commenters come across as survivalists so it's probably a nice antidote to reading all the buy recommendations from brokers.