The market is groggy after taking so many hits lately and despite good follow through on Wall Street, the index is down 7 points after 38 minutes. The commentary is that we had our bounce on the China data yesterday, but US indices moved further than the gains implied by the futures in our session yesterday and our market is heavily leveraged to Chinese activity.

FMG has been upgraded by another broker and I've bought stock at 633 on a breakout. I still have Jun 650 calls but I need a chunky move to get my money back there and they expire in a week. My stop on this stock is 615 although I'll pull it up to 626 (just below today's low) if the stock can push on today.

10.51 Just noticed that there was a pre-market crossing of 18 million shares in FMG at 626. Wonder if that was the stock overhanging the market...

11.50 The index is down 14 as Asian markets are flat to lower. Reserve bank governor Glenn Stevens speaks later today so that may influence the market. The question is how hawkish will the rhetoric be? All the signs are that the RBA is too far ahead of the curve and may have tipped the non-resource sector into recession. Real estate troubles are brewing and plenty of businesses are struggling or going bust. The joker in the pack has been a change in the psyche of the consumer from spendthrift to scrooge. The extent of this change has been unexpected and I'm sure that nobody expected the belt tightening to go on for as long as it has. It seems to me that the mood of austerity is actually deepening despite economic conditions being broadly positive.

On top of that, you have the snowball effect of internet shopping. After a few years of buying the odd book or CD, consumers are spreading their wings and buying all sorts of products on the net. I've just bought some prescription sunglasses at the local optometrist and I see that I'm paying 2 to 3 times the price that I need to; now that I have my prescription details, I won't be wasting money next time.

The effect of this is that it won't just be bookshops that are closing down but all sorts of businesses besides. Fat retail margins have supported an edifice of ridiculous rents and property trusts may be the next domino. I can certainly see the rationale behind shorting Aussie banks too as their fortunes are inextricably tied up with this. Like most scenarios, though, it's a matter of working out what is priced in already.

1.25 Thanks Glenn....NOT. Down 20 points as the RBA governor re-iterates his desire to flay the skin off the back of the economy.

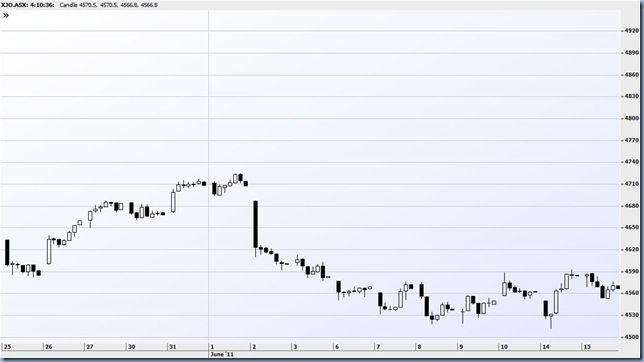

1.47 Still dropping, down 28 points but on low volume, characteristic lately. Stock futures roll over tomorrow morning so there may be more meaningful action then. Broadly, I'm expecting the low which was struck yesterday to hold. It was a strong reversal and you'd hope for more follow through.

WBC gave me the opportunity to sell calls at the stock level I was hoping for, a little below the last swing high of 2228. Unfortunately, I was too bullish after the reversal and let the chance slip by.

2.53 I'm getting cold feet about my long position in OST. I bought a few at 190.5 and did some better buying at 181. The stock has tried to rally off this higher low but the best it did was a brief push to 187.5. The stock is in a long term downtrend so the chances of this being a key turning point are low. I was simply looking for a rally to 195-200 but no acceleration has come through. Unless it starts to look great in the next hour, I'd rather just get out.

3.02 The bid was getting thin in OST, so I stopped out at 182.5. This despite Prime Minister Gillard's soothing words that the steel industry would be looked after under the new carbon tax regime. The magic pudding carbon tax regime.

4.12 The final loss was 18 points but the 60 minute chart looks ok, as if today was a retracement with the possibility of more gains ahead. A good performance after Glenn Stevens tipped a bucket of iced water into the lap of the economy.

No comments:

Post a Comment