Ben Bernanke's testimony was enough to put a shiver through the US market and the indices dropped late after looking on track to post another winning day. The local market has been quite resilient and also very whippy as it's option expiry day. After 75 minutes, the index is in the red to the tune of 11 points, having opened weaker, rallied and softened again. It's a mixed picture for me with shorts in FMG and LYC stubbornly holding on to a few cents of early gains but OSH well down and CPU looking promising as it failed to sustain an early bounce.

TLS has announced the NBN deal and I'm not on top of the details yet. However, the stock has reversed course after an early rise and is down at 299. I was regretting having bought June rather than July puts as I felt it wise to take what premium was left yesterday on the June 301 puts. Expiry day has bought some reasonably priced July puts and with the stock very close to a 298 sale, which would confirm a change in short term trend, I've bought July 300 puts at 6.

What I like about this trade is that the long position, driven by a great yield, is a very overcrowded trade so there could be a rush to the exits.

On a 60 minute scale, the index is holding above the breakout level from Tuesday. The bullish case is that the institutions will be looking to support the market as we approach the end of the financial year. The bearish case is that a lot of the fund managers that you see on the financial tv stations are in no hurry to buy. I'm tending to the bearish camp simply because we remain in a downtrend and I hope the index slides right through that support level this afternoon.

11.58 I didn't think it would happen before lunch but with the HSI opening weaker, the XJO took fright and sold down to 4504. It's at 4512 now, down 21, but the die is cast and I'm pretty comfortable with the short positions. Just as well, I will be out of the office until about 2.15 pm so I didn't want to be fretting too much.

I've almost closed out the OSH short, buying stock as the puts are intrinsic and will exercise automatically tonight. I've bought at 654, 652 and 647.

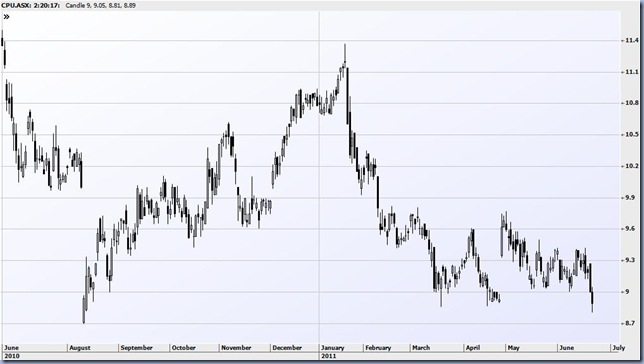

2.12 The last two hours has been a period of consolidation. I bought CPU July 900 puts at 30 before leaving as I'd like to hold that short position via options. I delayed selling the June 900 puts and was lucky enough to get them away at 16 as the stock fell as low as 881, back at 888 now. I include the CPU daily chart over a longer time frame than usual, you can see that there's a chance that this break could be the start of a longer selling wave because the consolidation was quite lengthy.

TLS is steady but did trade at 298 to confirm that sell signal while FMG has traded below yesterday's low to give a fresh entry. As with CPU, I've bought some July puts instead of letting the exercise of June puts leave me with a simple short stock position.

3.32 I've hedged up the last of the expiring June 625 puts in FMG with stock at 603 so just have the new July 625 puts at 32.5. The Asx 200 is back on the lows, down 29.

4.12 The index shed 32 points to finish at 4500.5. A reasonably good day for me with CPU and TLS finishing close to their lows. Short via July puts in CPU, FMG and TLS and still running a small short in LYC which edged up 2 to 204. I did pick up a few bucks shorting some extra LYC early on which I bought back later.

Here's the updated Telstra chart.

No comments:

Post a Comment