The release of oil from US strategic reserves and a misunderstood communiqué from the EU were enough to jolt the US Dow Jones and the S&P 500 indices (almost) back to square after a near death experience early on in the night. Overnight futures are reflecting that recovery with further small rises. Meanwhile, European bourses were heavily lower.

I'm staying with the theme that the downtrend is intact and the US recovery is probably as much to do with the fact the QE2 is continuing to provide liquidity to the US market. Nevertheless, the Aussie market is up 8 after 43 minutes and the potential is there for a higher low. It's partly why I'm using more options than usual at the moment. After such a long downtrend, we're vulnerable to sudden short squeezes.

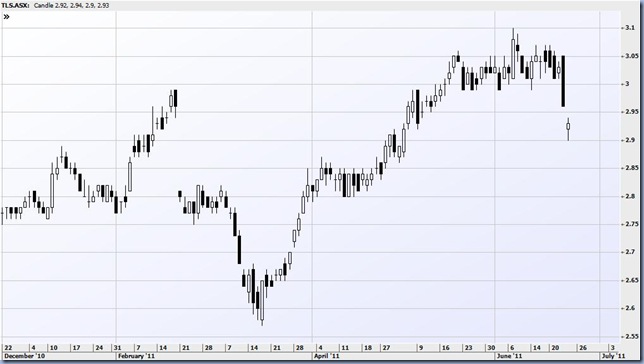

Telstra was sold off from the opening, hitting a low of 290. It was a big move for such a stodgy stock and some buying has pushed it back to 292. I'm offering half of my puts at 12 which would cover the cost since I bought them for 6. The opening trade was 11 in these July 300 puts but the stock bounce has left me out of the market. I'm hoping that the stock will slide away once the bargain hunters have got set.

10.55 The gold price followed oil lower last night and it now looks as if a lower high is in place after a choppy 5 wave retracement from the May 5th low.

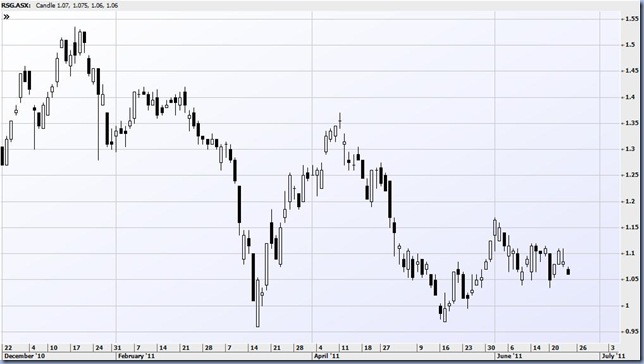

I've shorted gold stock Resolute at 106.5. It bounced from a May 17 low to reach 117 but that now looks like a wave 4 retracement which just failed to break the significant wave 1 low at 119. If it can duck through Monday's low at 103.5 then it could be a fast move to around 95.

11.18 LYC is starting to tip after rallying for most of the week. I've added to my short at 204 this morning but this is what I've been doing all week, selling the early strength to buy back later while keeping a core position. This time I might be able to hold the extra stock overnight because a sale at 200 might be enough to trigger the resumption of the downtrend.

I'm generally wary though, I've been playing this game of selling early just about every day this week but the market is setting up for a potential rally this afternoon. There's been a dip into the negative but it's only a few points below yesterday's low so there's not huge conviction.

11.36 Sold out half of the TLS puts at 11. The traders have backed off after buying a lot of these at 10 soon after the open. I sold to what looked like a non-trader bid.

12.10 The HSI is up over 1% but that market is a beneficiary of a lower oil price and it hasn't carried through to a rally in Australia.

2.48 The index did manage to turn around and is 15 points higher. Not too much damage to my positions though. TLS is down at 288; I've got the second half of my puts on the offer at 16 so will need a few cents more to get set. CPU has actually slipped lower to 888 which is still up 4 on the day but below this morning's levels and FMG is also higher but no worse than the morning peak.

Actually, the rally is largely confined to the top 20; there is marked outperformance there.

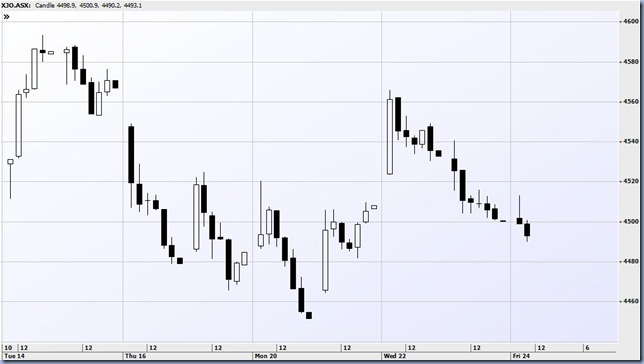

3.25 The market is just coming off an intraday high but I'm sceptical for now because the intraday action is choppy with overlapping waves. Here's the XJO over 14 days (10 trading days) on a 60 minute chart.

4.12 All over for the week with a late sell down trimming the gains to 8 points. It's been a battling week for me but at least I've seen a return to profitability after a couple of tough weeks. LYC wouldn't give ground and I closed out the day's short for a fractional gain. The rest didn't do much.

Chinese markets are particularly strong today and European markets are set to bounce strongly at the open after closing last night before the US saw its late rally. I'm still short and concerned about getting caught in a squeeze. Here's the daily XJO chart.

No comments:

Post a Comment