A flat night in the US after Bernanke tipped a bucket of cold water over a QE3 rally by ruling it out. Personally, I think it could be perversely bullish because QE3 expectations were just building in an overhanging of selling and a continuation of a crisis mentality. The Aussie market is up 7 after 29 minutes and needs to trade through 4577 – another few points away – to break the high of the last 2 days. Yesterday saw an afternoon rally as the RBA failed to raise rates. Nobody was predicting it, yet everyone was scared of another rise which shows the growing disconnect between private sector economists and the RBA. The significant thing was a toning down of the hawkish rhetoric and if it's the end of, or an extended pause in, the tightening cycle, it bodes well for our market and could be the circuit breaker.

Let's see if the Asx 200 chart will load...

I threw up my hands over the last couple of days and let a couple of stops go by without doing anything. That's worked so far in FMG and SPL. FMG traded through the last swing low on an intraday basis but has recovered and bounced back to 639 on upgrades and general strength in resources. With FMG, it wasn't really a stop, just the level at which I might short stock against calls...it hardly seemed worth it.

With SPL, I simply took note of the huge reversal in MSB (a biotech biggie) and figured that I should have a wider stop. Bought a couple more this morning at 147 and the stock is back up at 150; still below my entry price of 153.5 but well ahead of the intraday low yesterday.

11.03 I was quietly bullish today but the early promise has faded and the market is now down 16.

12.26 More of the same....down 46 points at 4520. The news wires suggest it's offshore selling.

1.04 The chart of the Asx 200 is grinding down but I'm wondering whether there'll be a rally back towards square this afternoon. The last two days have seen a rejection of intraday lows and closes back towards the high of the day's range. There's a turning point back in early January which illustrates the kind of pattern I'm thinking about. (to the far left of the chart). Admittedly, that was in a healthier overall market.

1.59 There's some improvement but not a bungee jump rebound.

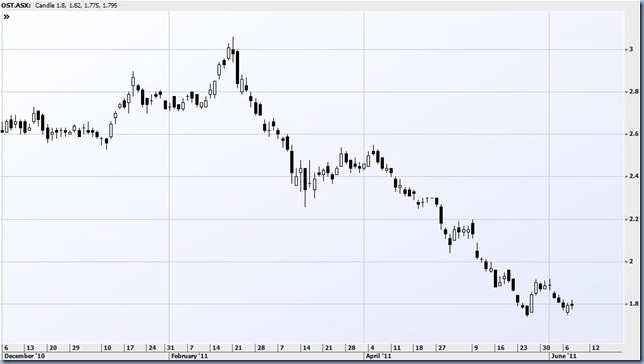

I bought a few OST the other day at 190. Fortunately not many and I was using the swing low as the stop since there was a gap through the tight stop. I've bought more at 181 today – with the same 173 stop. I'm hoping for a turnaround but watching for a simple a-b-c rally, maybe a move back to 188-192 and a failure. I'd definitely sell out half in that range and tighten up the stop for the rest.

3.50 The index recovered to a loss of 18 but has slipped away again. Yesterday's change in tone from the RBA was quite significant. If the pressure is off rates, then house prices should stabilise with high employment and a rental shortage, so the pressure should also lift from the banks. I've bought some ANZ and WBC over the last couple of days on that idea of the rejection of the lows. WBC is a more obvious reversal but ANZ is finding support too.

These trades are for my buy write strategy and I'm looking for a rally before selling calls. Here's ANZ.

WBC is already pulling away from Monday's low and I'm looking for a move to the recent swing high at 2228 before writing calls.

4.15 Down 29.5 at 4537. I've learnt how to highlight areas so note the ellipse to the left of the XJO chart. We haven't really got that sort of thing happening today but we have built in an overnight fall. The US charts are pretty weak but are near the bottom of longer term trend channels, so a rally is possible.

No comments:

Post a Comment