A couple of friends who are keen investors have been asking my opinion about gold lately. I've been cautious but as is often the case, these friends seem to pick turning points very well despite my advice to wait for confirmation of a trend.

A couple of friends who are keen investors have been asking my opinion about gold lately. I've been cautious but as is often the case, these friends seem to pick turning points very well despite my advice to wait for confirmation of a trend.Here's a chart of Spot Gold, priced in US dollars. It could be ready for a surge; it's made a mini break and a breach of 970-972 would be promising. Ncm and Lgl, the two leading stocks in the sector are shaping up bullishly....

It could be ready for a surge; it's made a mini break and a breach of 970-972 would be promising. Ncm and Lgl, the two leading stocks in the sector are shaping up bullishly....

....but I've decided to stay with the cut price end of the top 200 and bought into St Barbara Mines which has just made a small buy signal and is close to making a larger one if it trades at 25. Long at 24.

....but I've decided to stay with the cut price end of the top 200 and bought into St Barbara Mines which has just made a small buy signal and is close to making a larger one if it trades at 25. Long at 24.

I also sold out of Chc at 54 (v 53) as I had so few of them.

11.33 am Stopped out of Ehl at 78 (v 75) on a trailing stop.

The market is now starting to display a touch of vertigo as we've slipped 30 points from the early high to be at 4506, below the 4509 breakout level.

12.52 It's a fully fledged reversal day now with the market at 4485, down 5 points, and 52 points away from the early high. So far so good for my positions which are holding up relatively well. The banks are the saving grace of the market as they're strongly up on news that the bad debt cycle may have bottomed earlier than expected with the economy having outperformed gloomy predictions.

1.14 Stopped out of Gff now at 153 (v 147) as the stock has reversed again from Friday's run and I've put it in the 'too hard' basket.

3.56 The market had a brief attempt to recover but is slipping away again and it looks like a close on the lows. I'm holding onto my positions though. The new high (on the Xjo index) followed by a reversal is possible but I'm not going to jump at shadows, I'll wait until there's some confirmation. The Dow Jones Industrial Average has had 6 consecutive closes above the previous high so it seems unlikely that we'll just collapse instantly.

4.12 A rally in the Spi between 4 and 4.10 pm encouraged a few bids and the market closed down 10 points. In our region the Japanese market is flat to down but the Shanghai market is down 5% plus and that seems to have damaged the Hang Seng which is down 1.8% and the overnight US futures which are lower by about 0.6%.

You'll notice that each pullback overlaps the previous high and this is generally a sign that you're in a trading channel which won't be terribly exciting. Today's action put that idea in doubt because there's increasing momentum. The change in tone is encouraging and certainly analyst opinion is more bullish as wheat prices have fallen.

You'll notice that each pullback overlaps the previous high and this is generally a sign that you're in a trading channel which won't be terribly exciting. Today's action put that idea in doubt because there's increasing momentum. The change in tone is encouraging and certainly analyst opinion is more bullish as wheat prices have fallen.

The rest of my positions are going ok as you'd expect in a rising market. Gunns is closed, pending an announcement. There's an acquisition being negotiated but I think it's Gunns doing the buying and not someone making a takeover bid for Gunns - unfortunately.

The rest of my positions are going ok as you'd expect in a rising market. Gunns is closed, pending an announcement. There's an acquisition being negotiated but I think it's Gunns doing the buying and not someone making a takeover bid for Gunns - unfortunately.

It had one surge to a new high from early July on. Can it fire up again? Obviously, yes, it's possible but you might expect a deeper retracement first. The same goes for another top 20 stock, Cba.

It had one surge to a new high from early July on. Can it fire up again? Obviously, yes, it's possible but you might expect a deeper retracement first. The same goes for another top 20 stock, Cba. The other 3 major banks are stronger but not much and could easily make a slightly lower high.

The other 3 major banks are stronger but not much and could easily make a slightly lower high.

1.23 Thinking about the Ppx situation has sharpened my focus about the number of positions I have and the confused thinking that it reflects. I'm selling out of Lnc for 143 (v 146) because this is a turn round situation and has had only 3 white candlesticks in the last 5 weeks, hardly the high momentum trade I'm looking for. I can see the possibility of a good rally here but would need to buy towards the end of a strong up day.

1.23 Thinking about the Ppx situation has sharpened my focus about the number of positions I have and the confused thinking that it reflects. I'm selling out of Lnc for 143 (v 146) because this is a turn round situation and has had only 3 white candlesticks in the last 5 weeks, hardly the high momentum trade I'm looking for. I can see the possibility of a good rally here but would need to buy towards the end of a strong up day. 2.45 Out of Ipl at 340 (v 330) for no good reason, if I'm honest. I got nervous earlier when it fell back to 335 and sold out, then bought back in etc. I guess it means I've got no conviction on the trade although the chart still looks good to me.

2.45 Out of Ipl at 340 (v 330) for no good reason, if I'm honest. I got nervous earlier when it fell back to 335 and sold out, then bought back in etc. I guess it means I've got no conviction on the trade although the chart still looks good to me. 4.52 The market ended with a gain of 49 points. Ppx finished strongly at 64 and Gns looks like it might kick on after a short consolidation.

4.52 The market ended with a gain of 49 points. Ppx finished strongly at 64 and Gns looks like it might kick on after a short consolidation.

The S & P 500 index has the same shape.

The S & P 500 index has the same shape.

Valuations suggest that the Australian market is cheaper than the US and with the economy continuing to surprise with its strength there is good reason to think that our market can outperform the US.

Valuations suggest that the Australian market is cheaper than the US and with the economy continuing to surprise with its strength there is good reason to think that our market can outperform the US. I suspect that unless it reverses back up sharply, the wisest move would be to sell out on a retracement rally. I'm hopeful it will retrace as it bounced off the earlier sell down to 132.

I suspect that unless it reverses back up sharply, the wisest move would be to sell out on a retracement rally. I'm hopeful it will retrace as it bounced off the earlier sell down to 132.

1.04 Out of Omh as it has reported and there's little enthusiasm. The stock is drifting towards the bottom of the range. Sold at 175 (v 190).

1.04 Out of Omh as it has reported and there's little enthusiasm. The stock is drifting towards the bottom of the range. Sold at 175 (v 190).

11.20 am Lynas is also looking fairly positive but it needs to push past yesterday's high and there's quite a lot of stock on the offer in a market which is now only up 15 points.

11.20 am Lynas is also looking fairly positive but it needs to push past yesterday's high and there's quite a lot of stock on the offer in a market which is now only up 15 points. 1.13 pm The ASX top 200 index is now even on the day. Looking at the chart of the Xjo at the 60 minute level, it's still holding above 4350 support although it's finding great difficulty in rallying back towards the highs despite reasonable overnight leads. All in all, it makes for a wait and see type market.

1.13 pm The ASX top 200 index is now even on the day. Looking at the chart of the Xjo at the 60 minute level, it's still holding above 4350 support although it's finding great difficulty in rallying back towards the highs despite reasonable overnight leads. All in all, it makes for a wait and see type market.

Paperlinx is one I mentioned the other day. It obviously surged on Friday and I would like to have bought then on a break of 52. However, it has the look of a stock that could be moving into an expansive pattern so I paid 55 to get set.

Paperlinx is one I mentioned the other day. It obviously surged on Friday and I would like to have bought then on a break of 52. However, it has the look of a stock that could be moving into an expansive pattern so I paid 55 to get set. I've increased the number of bars on the Ppx chart below. When I say that I think Ppx is in an expanding pattern what I mean is that the surge in February completed a leisurely retracement by early July. In Elliott wave terms it might be a wave 1 then a wave 2. If that's the case then we're early in a wave 3 which could quick move above the February high in the low 70s.

I've increased the number of bars on the Ppx chart below. When I say that I think Ppx is in an expanding pattern what I mean is that the surge in February completed a leisurely retracement by early July. In Elliott wave terms it might be a wave 1 then a wave 2. If that's the case then we're early in a wave 3 which could quick move above the February high in the low 70s.

...but when I look at the daily chart I can't quite imagine an explosive move. It's quite possible it will move slowly at first. I guess if it finished strongly on good volume that would be a clue.

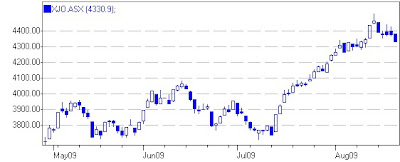

...but when I look at the daily chart I can't quite imagine an explosive move. It's quite possible it will move slowly at first. I guess if it finished strongly on good volume that would be a clue. 3.49 Nearing the close, the ASX top 200 index is down 1.4% as regional markets also fall and the US overnight futures are weak. Here's the daily of the Xjo.

3.49 Nearing the close, the ASX top 200 index is down 1.4% as regional markets also fall and the US overnight futures are weak. Here's the daily of the Xjo. It looks super extended and due for a pullback but it has done for a week or so. However, when I focus on my stocks they seem to be charting positively for the moment. Also, when I drill down to look at the 60 minute chart of the Xjo, there's still a possibility that this is a retracement of the surge on Thursday and the gap open on Friday. If the index holds above the highs of early August there could be a completion type run up to a marginal new high.

It looks super extended and due for a pullback but it has done for a week or so. However, when I focus on my stocks they seem to be charting positively for the moment. Also, when I drill down to look at the 60 minute chart of the Xjo, there's still a possibility that this is a retracement of the surge on Thursday and the gap open on Friday. If the index holds above the highs of early August there could be a completion type run up to a marginal new high. 4.12 The market closed on its lows, down 1.6%. Stockland failed to hold but I bought a small amount of Infigen on the close. They've got a lot of the old Babcock and Brown wind assets. I'm often reluctant to jump in when stocks have already run like this but at the moment there's usually good follow through buying so I've bought a small amount; half as an experiment and half to encourage me to develop the habit of buying the strong breakout. Here's the chart.

4.12 The market closed on its lows, down 1.6%. Stockland failed to hold but I bought a small amount of Infigen on the close. They've got a lot of the old Babcock and Brown wind assets. I'm often reluctant to jump in when stocks have already run like this but at the moment there's usually good follow through buying so I've bought a small amount; half as an experiment and half to encourage me to develop the habit of buying the strong breakout. Here's the chart.

4.12 The Xjo powered right on through to the close finishing with a gain of 2.1% or 93 points. Took some profit in Gff at 152 (v 146) and Mah at 56 (v 49.5).

4.12 The Xjo powered right on through to the close finishing with a gain of 2.1% or 93 points. Took some profit in Gff at 152 (v 146) and Mah at 56 (v 49.5).