I bought at 134.5 and then realised that there was more than a million stock on the offer in one line which, given that the stock trades a little over a million shares a day, was a potential dead weight on the stock. Luckily someone has bought the lot and now the shares have spiked quickly to 138.5.

Lyc has also rallied today, up as far as 58.5, although back to 56, 57 now. I bought a few extras at 56.

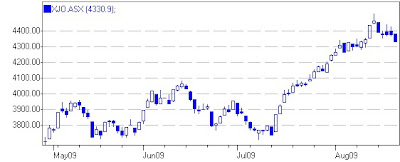

11.32 am The market has had another leg down. There's no obvious trigger but certainly there's a short term sell signal on the top 200 index now. However, it's in the context of a strong up trend so not one for the faint hearted.

12.34 When the market broke support at 4350 it fell to 4305 very quickly and hasn't bounced much since then. The Nikkei (which rallied strongly yesterday) is down about 1.3% but interestingly the Shanghai market, which precipitated the nervousness this week, is up 1% and the Hang Seng is also up moderately. Anyway, that's just background. The futures are showing no signs of bouncing yet, and even in the short term the bearish patterns look incomplete.

I've got one problem position in Gff which I was too keen to jump back into. It has kicked lower this morning and fallen - too quickly to react - to 143. The recent swing low is 141 so I'm staying with the position with a stop just below 141. Actually, that's not strictly accurate. What I'm thinking is that 141 is unlikely to break today and I should get a chance to stop out at a better level, there's no obvious strength any more and I'd rather be in something like Awb which has the potential to have 2 or 3 consecutive strong days.

1.49 The short term bearish patterns were definitely incomplete as the fall has gathered momentum. We're now down 100 points or 2.3% and just a few points above recent lows. Looking at the top 50, the falls seems pretty broad based. Asian markets have followed suit, with the Hang Seng also weaker now. As far as my positions go though, there's not much change and Awb is even a bit firmer as it pushes 140.

2.40 The market has just bounced a touch off its new lows, down 103 points now. Stopped out of Gff at 140.5 (v 150) as it failed to hold the next support level down.

3.40 A recovery late in the day has seen us rally to be down 78 points. Unlucky in Gff, broke the second support and then bounced back - oh well, it happens. Otherwise, Awb and Lyc still strong.

4.10 That's about it, a 2% fall. Another reason for the weakness is that the Future fund sold 5% of Telstra to various local fund managers who may in turn have had to sell to pay for it.

No comments:

Post a Comment