The market won't roll over and die and today we've fought back from an early sell off on the back of the NAB profit announcement and sympathetic weakness in the other banks. Cba has recently hit 3614 after opening nearer to 3500 and trading as low as 3485 - it's 11.46 am now, so that's in less than 2 hours. The rest of the market has followed suit so my predominantly short set of positions is down a bit. I did sell some more puts early in cba at 196 (v 115) but I've bought a few more may 3200 puts in bhp at 105, may 3150 puts in mqg at 270 and may 3700 puts in wpl at 111 as I'm taking the view that the rally will fail. Mind you, I'm a bit less confident than I was earlier on. Here's a 60 minute chart of the xjo.

It's starting to look as if the index might trade above yesterday's high around 3780. If that's the case then it'll be an unusual pattern with a new low made y'day versus last Friday but then a new high today. It can be a corrective pattern ie an expanding top or it could just mean there's a lot more strength than I expected.

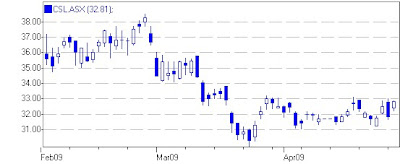

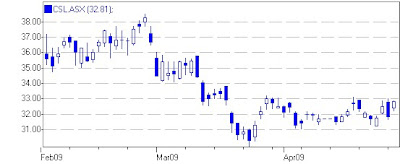

11.56 I've been bullish on csl for a week or two now and bought some april 3250 calls which expired last Thursday hoping for a quick run up. There's a line of resistance at 3300 and a break of that could trigger some acceleration. I'm happy to pre-empt a break with some may or june calls but I hesitated at 3250 and now the stock has run up to 3283. Here's the daily.

I think I'll wait now for a proper break as there's not much to gain buying just below 3300.

1.20 The market is like Melbourne weather at the moment. If you don't like it, wait a couple of hours and it'll change. The xjo index just failed to break yesterday's high (so far) as did the broader xao (all ords) and the spi likewise. The futures contract has made a short term sell signal, we're already 27 points off the day's high and US futures are now down nearly 1% so although it seems unlikely that lightning will strike twice I guess it's possible that we could get slammed again.

All this is idle conjecture, I haven't done anything else since my early session put trades and I'm awaiting developments.

1.25 Actually that's wrong - I bought more mqg may 3150 puts at 240 to average 255.

2.30 I bought more wpl may 3700 puts at 98 to average 106 for the day. Now the market has fallen again to be down 5 points. I sold out the extra bhp puts at 120 (v 105) and a couple of the mqg puts at 275 (255).

2.35 Out of a few of the amp may 550 puts at 41 (v 39). I think the stock is going to fail but it's bounced off 514/516 a couple of times so I'm just taking out a bit of insurance.

2.46 Bought Csl June 3300 calls at 192 as the stock broke through 3300. It's already up nearly 4% on the day but the daily chart (which is further up the page) looks to me as if it's moving into a larger trading range. Citigroup has also put out a note suggesting that Csl could benefit from a gov't flu response and of course, it's a safe haven which after the rally is no longer at much of a premium to the broad market.

3.20 Decided to short QBE, the largest Australian insurer as the US overnight futures are down about 1.5% on worries about the banks and I'm guessing that other financials could suffer too. Here's the daily.

Once again, I'm trying to get in ahead of a break which would be a sale below the recent low of 1978. It's trading at 2027 right now and I went short by buying may 2000 puts at 76.

Our market is only down 10 points but the Nikkei and the Hang Seng are both down well over 1% after having started firmer.

4.10 The market closed down 23 points as the futures tailed away. Csl was pleasing, holding the break of 3300 with a close at 3315. Amp closed at 509 and looks ready for a sharp fall. The recent low, 5 days back, was at 508. The rest of my shorts were also weak with qbe closing at 2003. During the day I traded out of my puts bought in the late morning for some day trading profits in bhp, mqg and wpl. I added a new long in csl and a new short in qbe and reduced the size of my short positions in amp and cba, taking a little profit.

The recent low, 5 days back, was at 508. The rest of my shorts were also weak with qbe closing at 2003. During the day I traded out of my puts bought in the late morning for some day trading profits in bhp, mqg and wpl. I added a new long in csl and a new short in qbe and reduced the size of my short positions in amp and cba, taking a little profit.

I'm hoping that this is finally the start of a new trend but the xjo hasn't failed yet so it's quite possible we could have another day in the range tomorrow.

...and the 30 minute chart of wpl.

...and the 30 minute chart of wpl.

The daily, above, reminds me of kzl a couple of weeks ago just before it jumped hard.

The daily, above, reminds me of kzl a couple of weeks ago just before it jumped hard.

I suppose the reason I only took off a few puts this morning is that I'm looking for a larger scale move.

I suppose the reason I only took off a few puts this morning is that I'm looking for a larger scale move.

3.30 Qbe has been as high as 2107, surprising me with its strength, but the 60 minute chart shows it's just bouncing aroung in a range. Perhaps, there's some switching out of the banks into this.

3.30 Qbe has been as high as 2107, surprising me with its strength, but the 60 minute chart shows it's just bouncing aroung in a range. Perhaps, there's some switching out of the banks into this. 4.01 Sonic Health, shl, is firming up with the rest of the sector. There's a buying opportunity with the stock having decisively rallied through last week's high but it's a little extended and I'll try to wait for a better opportunity.

4.01 Sonic Health, shl, is firming up with the rest of the sector. There's a buying opportunity with the stock having decisively rallied through last week's high but it's a little extended and I'll try to wait for a better opportunity. 4.14 The match out had the xjo finishing down 13 points on the day. It was hard to tell which way it would go with the opposing forces of weak banks and mildly bullish US and Asian influences. Not a lot of change to my positions. I added to my short in qbe on the rally and reduced the short, taking a little profit, in bhp and wpl. Shl is on the watch list for tomorrow. A slightly negative day for me to end a run of good results but cba was satisfying.

4.14 The match out had the xjo finishing down 13 points on the day. It was hard to tell which way it would go with the opposing forces of weak banks and mildly bullish US and Asian influences. Not a lot of change to my positions. I added to my short in qbe on the rally and reduced the short, taking a little profit, in bhp and wpl. Shl is on the watch list for tomorrow. A slightly negative day for me to end a run of good results but cba was satisfying. It's starting to look as if the index might trade above yesterday's high around 3780. If that's the case then it'll be an unusual pattern with a new low made y'day versus last Friday but then a new high today. It can be a corrective pattern ie an expanding top or it could just mean there's a lot more strength than I expected.

It's starting to look as if the index might trade above yesterday's high around 3780. If that's the case then it'll be an unusual pattern with a new low made y'day versus last Friday but then a new high today. It can be a corrective pattern ie an expanding top or it could just mean there's a lot more strength than I expected. I think I'll wait now for a proper break as there's not much to gain buying just below 3300.

I think I'll wait now for a proper break as there's not much to gain buying just below 3300. Once again, I'm trying to get in ahead of a break which would be a sale below the recent low of 1978. It's trading at 2027 right now and I went short by buying may 2000 puts at 76.

Once again, I'm trying to get in ahead of a break which would be a sale below the recent low of 1978. It's trading at 2027 right now and I went short by buying may 2000 puts at 76. The recent low, 5 days back, was at 508. The rest of my shorts were also weak with qbe closing at 2003. During the day I traded out of my puts bought in the late morning for some day trading profits in bhp, mqg and wpl. I added a new long in csl and a new short in qbe and reduced the size of my short positions in amp and cba, taking a little profit.

The recent low, 5 days back, was at 508. The rest of my shorts were also weak with qbe closing at 2003. During the day I traded out of my puts bought in the late morning for some day trading profits in bhp, mqg and wpl. I added a new long in csl and a new short in qbe and reduced the size of my short positions in amp and cba, taking a little profit.

The next position was a short in bhp. This broke down about 3 days back and has been retracing. I'm hoping for a failed rally and once I got the sniff that today would be a reversal day I decided to buy the May 3200 puts. I paid 127 for them.

The next position was a short in bhp. This broke down about 3 days back and has been retracing. I'm hoping for a failed rally and once I got the sniff that today would be a reversal day I decided to buy the May 3200 puts. I paid 127 for them. The last 2 sell offs have been about 250 and 270 c respectively. If the stock does something similar then it could fall to around 3000 in two or three days.

The last 2 sell offs have been about 250 and 270 c respectively. If the stock does something similar then it could fall to around 3000 in two or three days.

I've bought May 550 puts at 39, which means I'm short the stock at 550 less 39, or 511. The stock is trading at 524 so I'm short at worse than the market; however I only risk the 39c cost of the put which is why I have to pay a premium.

I've bought May 550 puts at 39, which means I'm short the stock at 550 less 39, or 511. The stock is trading at 524 so I'm short at worse than the market; however I only risk the 39c cost of the put which is why I have to pay a premium.

12.38 Also stopped out of my short in bsl at 261 (vs 267) earlier. Prematurely, as it's now back to 256.

12.38 Also stopped out of my short in bsl at 261 (vs 267) earlier. Prematurely, as it's now back to 256. I've been in and out of rio today for a small profit as there are a few day trading opportunities on this retracement day. I've closed out the mqg stock at 3146 average vs a buy price of 3056 for a small profit.

I've been in and out of rio today for a small profit as there are a few day trading opportunities on this retracement day. I've closed out the mqg stock at 3146 average vs a buy price of 3056 for a small profit.

Up until two days ago there was a pattern of higher lows and higher highs but with fading momentum so that the new highs were marginal and the lows were getting closer together. Then the 4% down move formed a lower low for the first time since early March. I suspect that the rally last night won't push on to new highs and we could have a short term change in trend forming.

Up until two days ago there was a pattern of higher lows and higher highs but with fading momentum so that the new highs were marginal and the lows were getting closer together. Then the 4% down move formed a lower low for the first time since early March. I suspect that the rally last night won't push on to new highs and we could have a short term change in trend forming. 12.30 Just bought some tls at 325 as I'm taking the view that it has found support just below this level having potentially made a lower low and could swing up towards recent highs.

12.30 Just bought some tls at 325 as I'm taking the view that it has found support just below this level having potentially made a lower low and could swing up towards recent highs.

One thing I'm trying to do at the moment is get into positions earlier and to that end I'm willing to accept less certainty especially if there's a level nearby where I can stop out if I'm wrong.

One thing I'm trying to do at the moment is get into positions earlier and to that end I'm willing to accept less certainty especially if there's a level nearby where I can stop out if I'm wrong.

Obviously, if there was a trend change, that is, a fall then a rally to another high followed by a further fall, then I'd be more bearish but for the moment it's a yellow light rather than a red one.

Obviously, if there was a trend change, that is, a fall then a rally to another high followed by a further fall, then I'd be more bearish but for the moment it's a yellow light rather than a red one.

3pm Gpt has gone very well and is now 58.5. Two other property stocks were also charting well, gmg and sgp, and they've both continued to run but rather than buy all three I decided to put on a larger position in gpt which I thought had the best chart. I guess, if you buy the group you're reducing the overall risk but I'd rather have fewer positions to manage. Talking of fewer positions, I'm having the most success in low priced stocks at the moment and I'm tempted to get out of csl, iag, and lei because they're churning and perhaps I'm a bit bored with the positions. I'll resist the temptation though because they're all holding above support and I still like the charts. I also think that even if the market has found a short term top, there's probably a retracement rally coming to test out Friday's early high.

3pm Gpt has gone very well and is now 58.5. Two other property stocks were also charting well, gmg and sgp, and they've both continued to run but rather than buy all three I decided to put on a larger position in gpt which I thought had the best chart. I guess, if you buy the group you're reducing the overall risk but I'd rather have fewer positions to manage. Talking of fewer positions, I'm having the most success in low priced stocks at the moment and I'm tempted to get out of csl, iag, and lei because they're churning and perhaps I'm a bit bored with the positions. I'll resist the temptation though because they're all holding above support and I still like the charts. I also think that even if the market has found a short term top, there's probably a retracement rally coming to test out Friday's early high.

Another stock that's gone vertical like kzl, has been Murchison Metals, mmx, in the iron ore sector. It's too late to buy this but I'm interested in another iron ore stock, Mount Gibson, mgx, which is behaving bullishly and has had a tight little correction after making a new high. If it runs above these recent highs, rather than gapping straight above them perhaps, I'd look to buy some.

Another stock that's gone vertical like kzl, has been Murchison Metals, mmx, in the iron ore sector. It's too late to buy this but I'm interested in another iron ore stock, Mount Gibson, mgx, which is behaving bullishly and has had a tight little correction after making a new high. If it runs above these recent highs, rather than gapping straight above them perhaps, I'd look to buy some.

The rest of my longs are up as you might expect on a strong day. The large caps are roughly up in line with the market although iag is doing a little better having risen 2.4% or 8c to 347, finally back above my buy price of 345. Of my older short positions, I'm comfortable with bsl and shl but I'm a bit concerned about tol which is up less than the market but is starting to chart quite well in the short term.

The rest of my longs are up as you might expect on a strong day. The large caps are roughly up in line with the market although iag is doing a little better having risen 2.4% or 8c to 347, finally back above my buy price of 345. Of my older short positions, I'm comfortable with bsl and shl but I'm a bit concerned about tol which is up less than the market but is starting to chart quite well in the short term. There was a higher low yesterday around 629 and we're near the top of the short term range here. A bit more strength and the stock could have a surge. So, I'm on the lookout in case I need to stop out here.

There was a higher low yesterday around 629 and we're near the top of the short term range here. A bit more strength and the stock could have a surge. So, I'm on the lookout in case I need to stop out here.