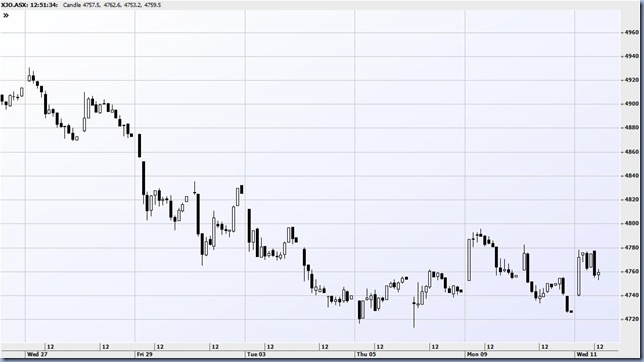

With the UK and the US markets closed for holidays, the early 35 point rise in the market is a surprise. The overnight SPI futures contract was indicating about a 14 point rise which was a reasonable guess, essentially a reversal of yesterday's drop. Maybe it's some end of month window dressing but I'm happy to see the rally. If the Asx 200 is going to halt at the top of the trend channel then this might be as good as it gets so I'm looking to sell out of anything that looks unconvincing.

First the bad news, I stuffed up my exit of the last few PDN. Selling on the open at 312 after twice trying and failing to sell at 322 on intraday retracements yesterday. Stock is 318 now. The good news is that 2 of my 3 main longs are doing well. The best is LNC which is continuing on after a few days consolidation. Up 9 at 312.

I was looking for coal companies with bullish charts yesterday as coal demand seems set to keep rising. I couldn't find anything and although LNC is, strictly speaking, a clean energy company, it's a nice coal play in the short term as it looks to sell its coal assets.

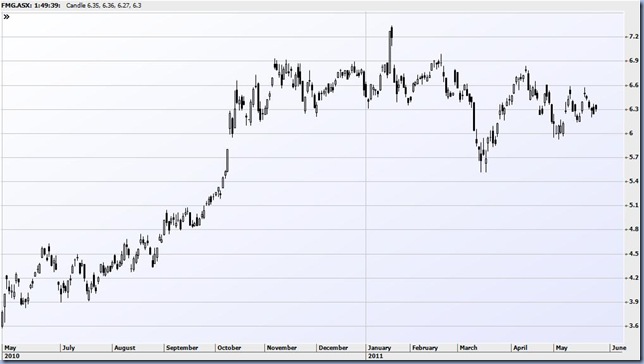

FMG is also firming, up 7 to 647, although the stock needs to hit around 660 before the breakout looks compelling.

The last of my larger long positions is in IPL and that's down 1 at 386 but still charting ok. My stop is below the 376 swing low and the obvious risk is that there's another leg down, although my view is that it would make a higher low.

I have a small long position in KAR. This has a similar chart to IPL (above) but is slightly more bullish having made a higher low in mid May. I sold a couple out at 655 (v 652) this morning.

I'm out of the AWE trade at 144 as it's stalling below resistance. This is a judgement call, the stock could still push on but with the overall market potentially stretched I want to stick to a few trades only.

My last position is in LYC and I intend to sell this today as it goes into the MSCI index. The stock might have been expected to run but it seems as if there are investors who are happy to sell into the index buying and the stock is up just 1 at 227. There's a big decision looming regarding the Malaysian refinery which is still under construction and news reports suggest that approval is not a sure thing. It might be wise to steer clear of the stock for a while and keep an eye on ARU which would be a beneficiary of delays at LYC.

12.12 The market is up 44 and stretching the downtrend channel. I'm getting tentatively hopeful that the rally might have more legs. Figures released at 11.30 showed Q1 exports lower, due to the floods presumably, and a generally softening picture vis a vis the consumer. No surprise again as the two speed economy is affecting most people.

1.41 LYC has begun to move as the weight of buying starts to tell. I bought some extras at 227 and they're in front with the stock at 230. I suspect I can afford to hold some of my position overnight (whether I want to will depend on how it closes) because there'll be more re-balancing activity tomorrow and I think the environmental approval process still has a week or two to go. Around the 230 level is obviously quite strong resistance; there were peaks in early January and early March and now the stock is once again bumping against this level. If there's a late pop today, there could be some technical buying and maybe some short covering.

2.47 The weekly chart of BHP has a buy signal, and they're often quite reliable on the weekly charts. The Asx 200 chart isn't quite there, held back by the banks.

I've bought some IPL June 400 calls at 6 cents each because if the market is able to make a sustainable recovery, it won't be much of a stretch for the stock to get to 420, 430. The chart is higher up the page.

4.03 I sold out the extra LYC at 233 average. The market overall is near the highs, up 46 points and is reflective of strength in the region with the HSI and the Nikkei both up strongly.

4.12 The Asx 200 closed 41 points higher at 4708. I sold out a few more LYC at 237 and have 10k left. I also sold 5k of LNC at 328, leaving a balance of 25k. The stock looks red hot but I wanted to take something off the table. Here's the daily. In Elliott wave terms, it looks like the 3rd of the 3rd. It closed at 328, up 25.

The month is over and it's been smack on budget thanks to two good days late in the month. A stock that's in a genuine bull market like LNC can really make all the difference. Mostly I'm chopping around in stocks that are going nowhere, making a few dollars here and there.

I've been missing one of the hot sectors in the market at the moment, which is biotech, but I'm starting to track a few stocks and might rotate a couple into my watchlist soon.