An oversold bounce has the Asx 200 back up 1.1% as the commodities rebound continued overnight. There's much talk about a copper shortage while coal and iron ore do better than expected.

My main computer had a video card problem this morning so it has been a scramble to fire up the old PC and get cracking. My long positions have bounced well with the market although I've got chopped in IPL as it bounces back through yesterday's high and I'm getting long again. I usually have a rule to wait for an a-b-c correction before anticipating a bounce, especially when the stock is not in an uptrend. For some reason, I totally forgot about that when I bought IPL the other day. Anyway, it's a better entry, although I haven't bought much as I want to see how the stock performs through the day.

AWE is a new long. The company has started drilling in its potentially huge onshore shale gas find in Western Australia. The chance is there for positive news flow. I'm buying on the break of yesterday's high. That bar could be a higher low and a conservative target might be 146 but good drilling news allows for plenty of upside since the stock has no premium for the story. Long at 137 with stop at 132.

11.50 On a more strategic note, I've been thinking about why April and May have been a wash out for me with reasonably good risk management being the only reason I'm breakeven for the period.

First of all, I'm biased towards a trading range with my strategy since that's what I anticipate in the bigger picture. The recent moves have been quite powerful although, ironically, they have been within a range. Secondly, I've been pre-empting without having at least some short term momentum to support the trade. Thirdly, when you get it right with these trades but there is no clear trend change, then you need to be very quick to take your profits. Sometimes I have but sometimes I haven't. Fourthly, I've only played it from one side. Therefore, in April, once I decided that the rally was overdone, I only looked for shorts rather than also taking continuation trades on the long side. In May, I've done the opposite.

Where does that leave me today? Well, I'm long and have my first positive indicator which is a break of yesterday's high after a strong downdraft. My opinion is that this should be the start of a reasonable recovery but that it will not go above the April highs and may fall a fair way short, say, 4800.

However, I have no proof of that and my strategy should be to cut my longs rapidly on a loss of momentum. Looking at the last swing up from last week as if this was a stock chart, I would have been cutting some of the long on the weak inside day last Friday and cutting the rest this Monday as Friday's low was breached. Considering that it was most definitely a downtrend, despite my thought that the 5th wave low would hold, I could have been putting on a short position on Monday on the basis that the bounce had (tentatively) made a lower high and the trend was intact. Today would be cut and reverse.

The basic principle of waiting for some sort of evidence that your scenario might be correct would also have kept me out of trouble on the short side in April since the first serious down day indicated the top and the most negative days were a few doji bars.

This is not earth shattering stuff but it comes out of examining my trades. Over the past 15 months I've found that intelligent anticipation can make the difference between breaking even and making a decent return. But after running through my trades, I found that it's still not worthwhile buying on a down day near support. It's better to pay a little more on an up day as it seems to provides a better quality stop and a higher probability entry.

For example, using the XJO chart above, I might have decided to buy on Monday's down day on the basis that the swing low would provide support. It's better to buy today, at much the same levels, but without the whole aspect of trying to catch a falling knife. It also makes trading easier since the market tells me what to do, rather than me having to pick a likely point.

12.25 Back to the market, LNC has burst through 300 to be up 20 at 306. Maybe there's a coal tenement sale brewing. Here's the chart. It's my biggest position so I hope there's some substance to the story.

1.33 Today is May expiration for exchange traded stock options. It tends to have a gravitational effect where the larger stocks will get sucked towards a round number and the overall effect is usually to limit intraday volatility. You can also get cheap options as the weight of numbers of investors rolling short positions means that the traders throw up their hands by the end of the day and wind their bid prices right back.

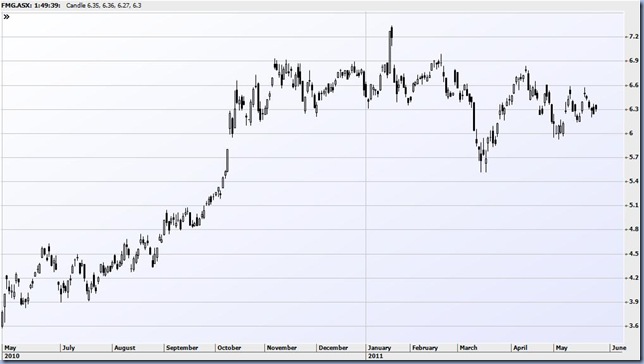

Which brings me to Fortescue. I think the stock could go either way at the moment, it's forming a sort of a pennant after it recovered but made a lower high in April. Despite the hint of a head and shoulders pattern, there's a definite possibility that the stock has had its correction and has also had wave 1 and 2 of the next move to a new high. In that case, the stock could burst through 700 to new highs. FMG June 650 calls offer a reasonable way to play this move. They're down 1.5 to 12.5 on the day, despite a 6 cent rise in the stock as option premium is offered lower. Expiry is in 4 weeks time on June 23rd so it's a fairly short cycle but since the stock has already consolidated for a couple of weeks (relative outperformance) there should be plenty of time.

2.41 Bought half of the FMG June 650 calls at 13.5 as the stock pushed up to 633. Looking at the 60 minute chart, if the stock pushes through 636, 637 then there'll be a short term break and I'll buy the rest. They'd probably cost a couple of cents more but the picture would be clearer.

3.03 Something to do with cutting back to my new PC after repairs but the news stories on LNC hadn't been appearing. Anyway, the sale process for the Teresa property is close to completion with one bid already received. $500 million plus is expected.

4.12 It was quite a squeeze today and the Asx 200 closed on its highs, up 75 at 4660. It's a pivot reversal, according to the Dow Jones news wire. Apropos the commentary earlier, I'm long and hoping for more.

FMG closed at 633 so I haven't bought the last portion of the calls. LNC, LYC, IPL and PDN all finished strongly. AWE hung around the early levels to close up 2.5 at 137.5.

No comments:

Post a Comment