It's been a tough June for me, my first significant losing month in what's been a pretty good year considering the state of the market. But I've finally come to terms with the pig's ear I've made of things lately and I'm looking forward to a fresh start tomorrow. The US indices rallied above the first recovery wave but haven't overlapped the last significant swing low so the situation is murky as to whether it's a wave 4 (a-b-c) rally or a more meaningful move.

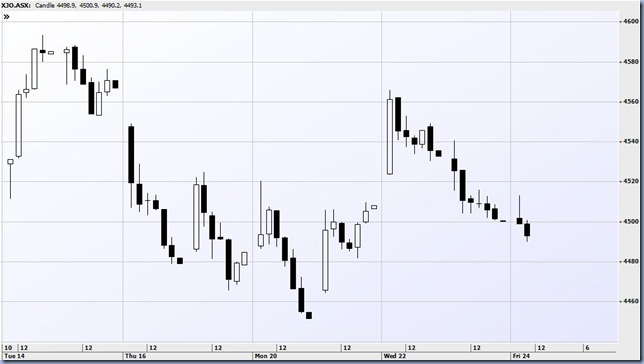

The market has just opened with a 35 point rise.

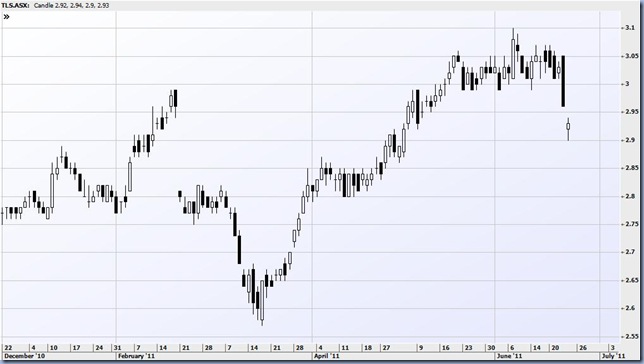

10.44 It's arguably a better picture in Australia where there's plenty of overlap on the chart. However, it's more like a trend channel where this swing is pushing the upper limits of the channel. If there's to be a breakout, it's likely that there'll be a pullback to the middle of the channel and then another surge. For now, I expect up to drift off although the June 30 factor muddies the waters.

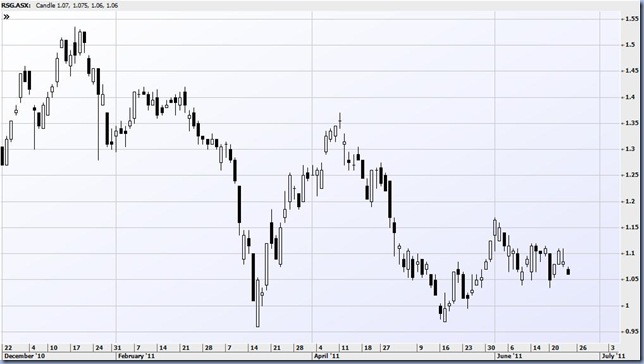

11.06 I got out of the RSG at 114 for a couple of cents my way. It was a momentum trade so I needed to get out quickly once the selling appeared.

11.43 Japanese and Korean markets are flat while the HSI is up 0.55% and easing having been open for a short while. The Asx 200 is therefore outperforming with a 30 point rise.

12.29 The HSI turned decisively northwards and has carried us up with it. The Asx 200 is now up 57 at 4587.

1.12 That's interesting, the rally in the Asx 200 has just broken the last swing high on the way down. It makes it very likely that the downtrend is over. Of course, there's short covering today and institutions are not going to sell much on the last day of a disappointing financial year, but despite that, it means that dips should be bought.

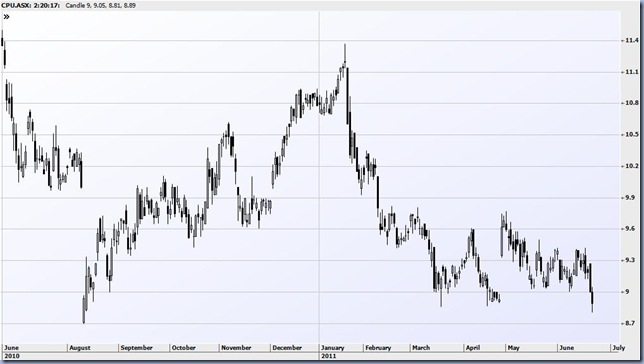

I've been a rabbit in the headlights over the last few days, seeing the potential but not able to act properly. FMG has kicked on today and I haven't managed to buy any stock there. I'm left with July 625 puts that are down to about 14 so I'm hoping for a second chance to buy in the next few days.

3.03 The index has just made another minor high above 4600 although this time its rejecting the level. It could be enough for the day. I'm stopping out of CGF though, it has been as high as 495 today and I'm buying a few at 490 versus an entry level of 482. I've made the odd jobbing profit around this position so it's pretty marginal.

4.10 Never a backward step as the long downtrend meant that there was nobody left to sell into the rally and the Asx 200 managed a 79 point gain to 4608. I'm disappointed that today just made a bad month worse – and it was the only bad month – but happy enough to be starting afresh tomorrow. I think I'll take things easy though.

This is the last post for Trading diary of a late riser. It's been a useful tool for me but my heart hasn't been in it lately. I hope that readers have got something out of it. I'm going to continue to write about trading but with a focus on the psychological element. The new blog is called Trading as therapy.