It's starting to look as if the index might trade above yesterday's high around 3780. If that's the case then it'll be an unusual pattern with a new low made y'day versus last Friday but then a new high today. It can be a corrective pattern ie an expanding top or it could just mean there's a lot more strength than I expected.

It's starting to look as if the index might trade above yesterday's high around 3780. If that's the case then it'll be an unusual pattern with a new low made y'day versus last Friday but then a new high today. It can be a corrective pattern ie an expanding top or it could just mean there's a lot more strength than I expected. I think I'll wait now for a proper break as there's not much to gain buying just below 3300.

I think I'll wait now for a proper break as there's not much to gain buying just below 3300.1.20 The market is like Melbourne weather at the moment. If you don't like it, wait a couple of hours and it'll change. The xjo index just failed to break yesterday's high (so far) as did the broader xao (all ords) and the spi likewise. The futures contract has made a short term sell signal, we're already 27 points off the day's high and US futures are now down nearly 1% so although it seems unlikely that lightning will strike twice I guess it's possible that we could get slammed again.

All this is idle conjecture, I haven't done anything else since my early session put trades and I'm awaiting developments.

1.25 Actually that's wrong - I bought more mqg may 3150 puts at 240 to average 255.

2.30 I bought more wpl may 3700 puts at 98 to average 106 for the day. Now the market has fallen again to be down 5 points. I sold out the extra bhp puts at 120 (v 105) and a couple of the mqg puts at 275 (255).

2.35 Out of a few of the amp may 550 puts at 41 (v 39). I think the stock is going to fail but it's bounced off 514/516 a couple of times so I'm just taking out a bit of insurance.

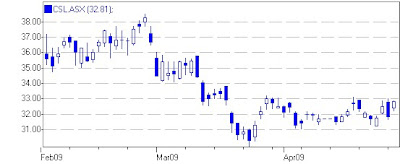

2.46 Bought Csl June 3300 calls at 192 as the stock broke through 3300. It's already up nearly 4% on the day but the daily chart (which is further up the page) looks to me as if it's moving into a larger trading range. Citigroup has also put out a note suggesting that Csl could benefit from a gov't flu response and of course, it's a safe haven which after the rally is no longer at much of a premium to the broad market.

Once again, I'm trying to get in ahead of a break which would be a sale below the recent low of 1978. It's trading at 2027 right now and I went short by buying may 2000 puts at 76.

Once again, I'm trying to get in ahead of a break which would be a sale below the recent low of 1978. It's trading at 2027 right now and I went short by buying may 2000 puts at 76.4.10 The market closed down 23 points as the futures tailed away. Csl was pleasing, holding the break of 3300 with a close at 3315. Amp closed at 509 and looks ready for a sharp fall. The recent low, 5 days back, was at 508. The rest of my shorts were also weak with qbe closing at 2003. During the day I traded out of my puts bought in the late morning for some day trading profits in bhp, mqg and wpl. I added a new long in csl and a new short in qbe and reduced the size of my short positions in amp and cba, taking a little profit.

The recent low, 5 days back, was at 508. The rest of my shorts were also weak with qbe closing at 2003. During the day I traded out of my puts bought in the late morning for some day trading profits in bhp, mqg and wpl. I added a new long in csl and a new short in qbe and reduced the size of my short positions in amp and cba, taking a little profit.

I'm hoping that this is finally the start of a new trend but the xjo hasn't failed yet so it's quite possible we could have another day in the range tomorrow.

No comments:

Post a Comment