On a daily and weekly basis the trend is intact with higher highs and lows but a look at some of the other major markets shows that divergence is developing. For example, the FTSE and the Hang Seng are following the S&P 500 but the DAX, the CAC, the Kospi and the Nikkei have all broken their uptrends, like the Xjo, even if they haven't all developed downtrends.

On a daily and weekly basis the trend is intact with higher highs and lows but a look at some of the other major markets shows that divergence is developing. For example, the FTSE and the Hang Seng are following the S&P 500 but the DAX, the CAC, the Kospi and the Nikkei have all broken their uptrends, like the Xjo, even if they haven't all developed downtrends.Just over an hour into the trading day and we've fallen in line with US markets continuing that recent theme of underperformance given that we seemed to be expecting this weakness for the last few days. We're down 1.3% which is only just above the day's lows. My positions are slightly outperforming with the exception of Aoe, which disappointed expectations by failing to announce anything to excite the market. It has dropped 9 to 413. I sold a few at 415 (v 396) and retain just under half of my position. Bsl has gone through my stop level but has found support so I'm hanging in temporarily to see if I can exit at a better level.

Aristocrat is the one that got away - I was tempted to short it yesterday afternoon but decided to wait for a retracement to get in at better levels. It's the biggest loser in my watch list down 5.5% at 431.

Also out of Bsl at 283 (v 290.5), so slightly better than the stop level of 280.

Also out of Bsl at 283 (v 290.5), so slightly better than the stop level of 280. On second thoughts, I'm probably too bullish. It did make a lower high in October and it's not surprising that there should be some support here.

On second thoughts, I'm probably too bullish. It did make a lower high in October and it's not surprising that there should be some support here.

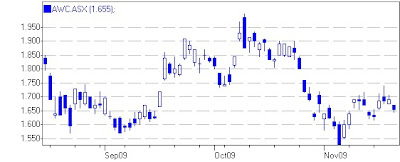

In the meantime, I've completed selling Awc at 165 to average 165.25 and I've shorted Asciano at 161.5. Aio is more difficult but it looks like the retracement rally petered out rapidly after tracing out a choppy pattern. I think it's a reasonable reversal in what could be the early days of a downtrend with lower highs and lows forming.

2.06 The drop in Aoe gathered momentum so I sold the balance out at 404 (v 396). I'd normally like to give it the opportunity to rally after a pullback but the sell off has been pretty steep and there doesn't seem to be much support.

2.06 The drop in Aoe gathered momentum so I sold the balance out at 404 (v 396). I'd normally like to give it the opportunity to rally after a pullback but the sell off has been pretty steep and there doesn't seem to be much support. 3.24 Interestingly Bsl is now up 2 on the day to be 288 so I could definitely have stopped out at better levels. I'm still in two minds about this one.

3.24 Interestingly Bsl is now up 2 on the day to be 288 so I could definitely have stopped out at better levels. I'm still in two minds about this one.The market has held the line from this morning. I shorted All at 432 and bought it back at 425 as I tried to get something out of this missed opportunity.

4.10 Regional markets have strengthened during our afternoon session and we've lifted slightly. I'm now only long Csr and Qan and short Aio, Awc, Djs and Tse. It hasn't been a particularly good day but neither has there been any real harm done and the week has been solid. The increased possibility that we've made a high here suggests that there could be some nice trades on the short side in the weeks to come.

Overall, the Xjo closed down 63 points.

Excellent Traders Site, Keep Up The Good Posting

ReplyDeleteRegards tturaniuminvest

If your Interested I've also compiled 3 Sites that maybe of Interest.

http://daytradingdiaries.blogspot.com/

http://australianuraniuminvesting.blogspot.com/

http://australianuraniumquicksearch.blogspot.com/

P.S. I've just placed a Link to your site within my http://daytradingdiaries.blogspot.com/ Site

.

.

Hi tturaniuminvest, I've just started checking some of your links...really interesting. Thanks very much.

ReplyDelete